As the government rolls out the new GST rates in 2025, buyers, sellers, and developers in the real estate sector must prepare for important changes. GST directly influences the cost of under-construction property, the price of a new flat purchase, and even the expenses involved in house construction. It also extends to the construction material GST rate, which silently pushes project costs higher or lower depending on tax slabs.

For homebuyers in Indore and across Madhya Pradesh, these changes are not just numbers on paper. They affect how much you pay for your dream home, whether it falls under affordable housing, mid-segment apartments, or luxury properties. Developers, too, will need to adjust to new GST registration charges, revised tax slabs, and compliance updates that shape pricing strategies.

Understanding these shifts in GST for house purchase is critical. A well-informed buyer can save lakhs by choosing the right property segment at the right stage of construction. This blog breaks down the new rules in simple terms and explains what they mean for you as a homebuyer, particularly in Indore’s fast-growing real estate market.

GST on Under Construction Property

The new GST framework for 2025 brings changes that directly affect buyers of under-construction property. Unlike ready-to-move flats, where no GST is applicable, under-construction flats and projects will continue to attract GST.

For a ₹40 lakh apartment in Indore, GST at 5% adds ₹2 lakh to the cost. Any change in this rate directly impacts affordability. The revised GST percentage ensures clarity and compliance, but requires buyers to factor it into their purchase plans.

GST for House Purchase and New Flat Buyers

For those considering a GST for house purchase in 2025, the updated framework brings both relief and caution. The GST for new flat purchases remains significant, especially for middle-income buyers in Indore’s growing areas like the Super Corridor and Ring Road.

Affordable housing projects will still enjoy lower GST, keeping them accessible for first-time buyers. The GST rate on new flat purchases is designed to balance affordability with government revenue.

GST Rate for Affordable Housing

Affordable housing continues to be the government’s priority, and the GST rate for affordable housing is structured to encourage homeownership. Flats classified under this category attract just 1% GST, compared to 5% for other residential units.

For example, on a ₹45 lakh flat in Indore under an affordable housing scheme, GST comes to only ₹45,000, while the same property outside this category could attract nearly ₹2.25 lakh in tax.

Construction Material GST Rate and Its Impact

The cost of construction material GST rate is a hidden but powerful factor in property pricing. Cement, steel, tiles, and other building material GST rate categories contribute heavily to overall costs.

- Cement remains one of the highest taxed items at 28%.

- Steel, tiles, and fixtures fall between 18–28%.

Developers pass these costs to buyers. A reduction in the construction material GST rate would ease pricing pressure, especially for large township projects in Indore’s outskirts.

GST on House Construction

For families planning to build independent houses or bungalows, the GST on house construction also matters. Every material and service involved in the process, from bricks to finishing, falls under GST.

Understanding GST building materials rates is crucial for budgeting, as these add up quickly in custom-built projects.

New GST Registration Charges and Tax Slabs

The 2025 reforms also touch on new GST registration charges and GST tax slab adjustments.

- For developers, streamlined charges mean easier compliance and faster approvals.

- For buyers, this indirectly translates into transparent pricing and timely project deliveries.

Luxury housing and high-value investments may see higher slabs under the new GST percentage, while affordable homes remain protected with lower rates.

Other Big Purchases: GST Beyond Real Estate

While the real estate market is the main focus, GST changes in 2025 also affect other big investments. For instance, GST on a new car purchase will influence household budgets for those planning multiple large transactions in the same year.

By staying informed, buyers can plan property purchases and other expenses in sync, ensuring no financial surprises.

What It Means for Indore and Madhya Pradesh

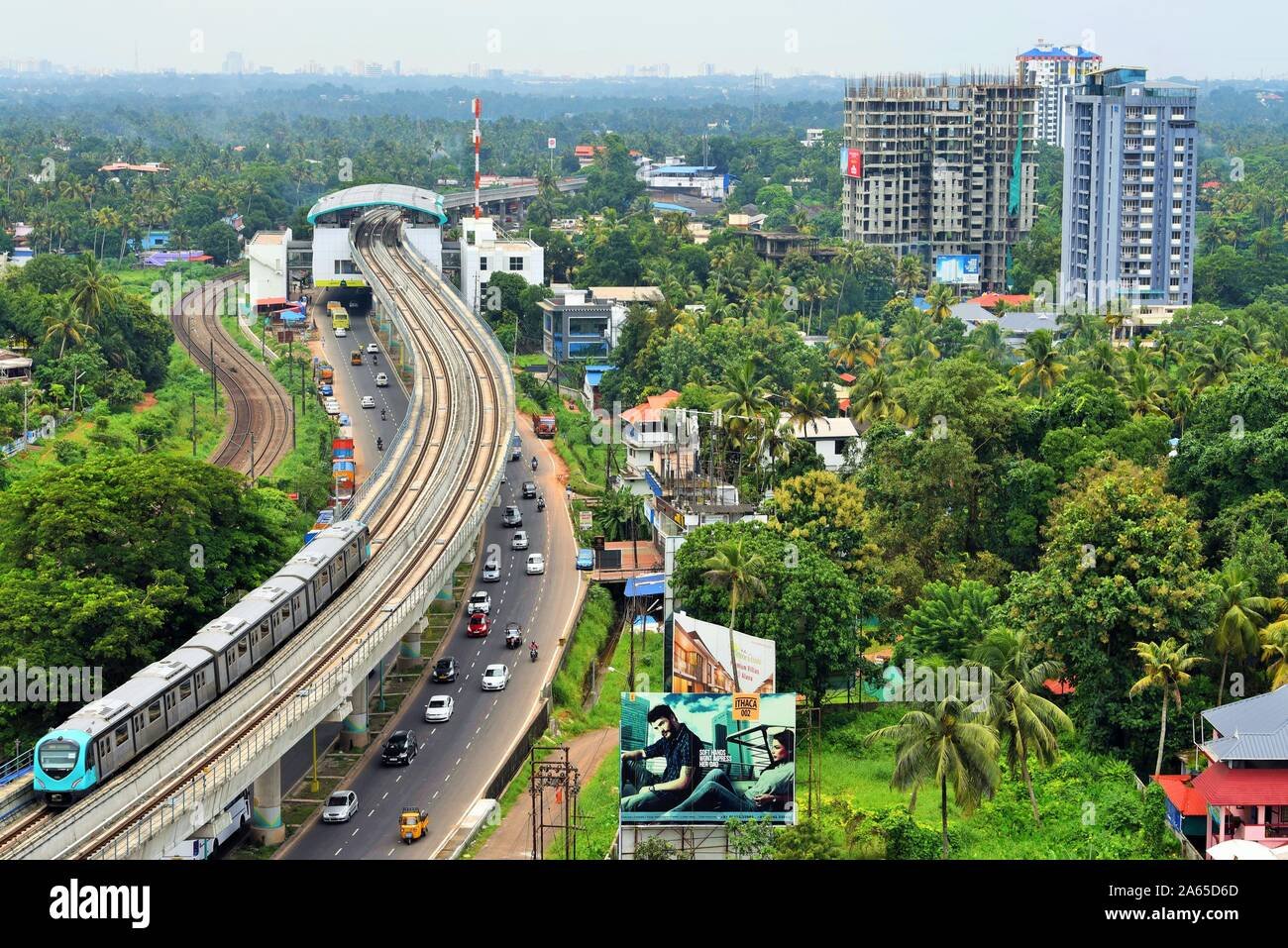

For Indore’s booming property market—driven by the metro corridor, Super Corridor, and township projects, these GST reforms bring clarity and predictability. Lower GST on affordable housing supports first-time buyers, while developers get relief from streamlined registration.

Madhya Pradesh is also expected to benefit from these reforms as they align with state-level housing schemes, making it easier for middle-class families to own property.

The new GST rates in 2025 will redefine how buyers and developers approach real estate. From under under-construction property GST to the construction material GST rate, every element plays a role in shaping property prices.

For homebuyers in Indore, the takeaway is clear:

- Choose projects wisely by comparing GST costs.

- Prioritize affordable housing for maximum savings.

- Stay updated on tax slab revisions to avoid surprises.

At Samprati Properties, as the best property broker in Indore, we ensure our clients understand not just the property but also the policies shaping its value. With expert guidance, you can make smarter, tax-efficient decisions in 2025’s evolving market.

Where Experience Meets Innovation.