Rise in income levels and favourable macro-economic indicators key factors.

Mumbai: Affordability of housing in India’s major property markets has improved in 2023, thanks to a consistent rise in income levels and favourable macro-economic indicators.

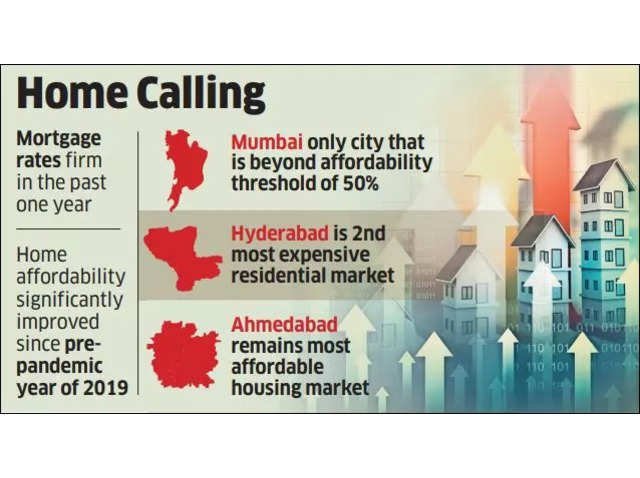

Despite mortgage rates staying firm in the past one year, the affordability level- the income proportion needed to cover monthly instalments for an apartment – has witnessed a positive trend.

While marginally better than last year, home affordability across cities significantly improved since the pre-pandemic year of 2019, showed a Knight Frank India analysis.

The consultancy firm expects this to further improve in 2024. “Anticipating stable GDP growth and moderation in inflation in FY2024-25, affordability is expected to strengthen. Further, if the RBI decides to lower the repo rate later in 2024 as is widely expected leading to a reduction in home loan interest rates, the affordability of homes in 2024 could see a note- worthy enhancement, providing a comprehensive boost to the sector,” said Shishir Baijal, chairman and managing director at Knight Frank India.

Affordability to further improve in 2024: Knight Frank India.

Responding to the inflationary environment, the RBI, through six successive increases since May 2022, had raised policy rates by a cumulative 250 basis points, taking the repo rate to 6.5% before hitting the pause in April this year. However, home loan rate at 9% and an up- tick in property prices have not impacted housing sales activity and prices have also seen an uptick.

“While residential prices have continued to rise in 2023, improved eco- nomic and job prospects, along with healthier income growth compared to 2022, have resulted in improving affordability for homebuyers. The upward trajectory in enquiry levels and actual sales conversions unmistakably signals this positive trend,” said Sandeep Runwal, president of Naredco Maharashtra.

Mumbai is the only city which is beyond the affordability threshold of 50%, a level exceeding which banks rarely underwrite a mortgage. The most-expensive residential market of the country has however seen an improvement of 2 percentage points in its affordability index measured at 51% in 2023 from 53% in 2022. Looking at the trend from the pre-pandemic period, the city has witnessed a significant improvement from 67% in 2019.

Ahmedabad remains the most affordable housing market in the country with an affordability ratio of 21% which implies that on an average a household in Ahmedabad ne- eds to spend 21% of its household income to pay EMI for housing lo ans. Pune and Kolkata followed with 24% each in 2023.

Source- The Economic Times