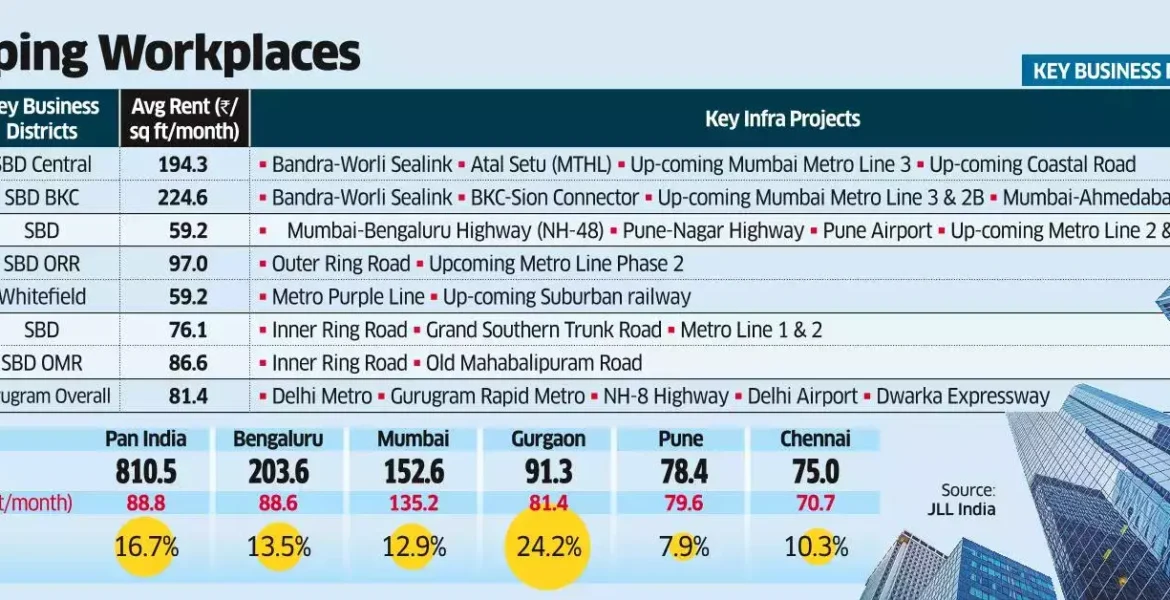

Changing needs, infrastructure development, etc create new office hotspots in top cities. Such hotspots could add 89m sq ft of Grade A office space to top 7 cities’ supply in 5 years.

Mumbai | Bengaluru | New Del- hi: The commercial real estate market in India’s major cities is transforming due to changing te- nant requirements, rapid infrastructure development and evolving workplace regulations, even as recent lease deals signal the cre- ation of new hotspots drawing companies and investors.

According to real estate consultancy JLL, the emergence of new business hotspots will contribute about 89 million sq ft to the Gra- de-A office supply in the top seven cities over the next five years.

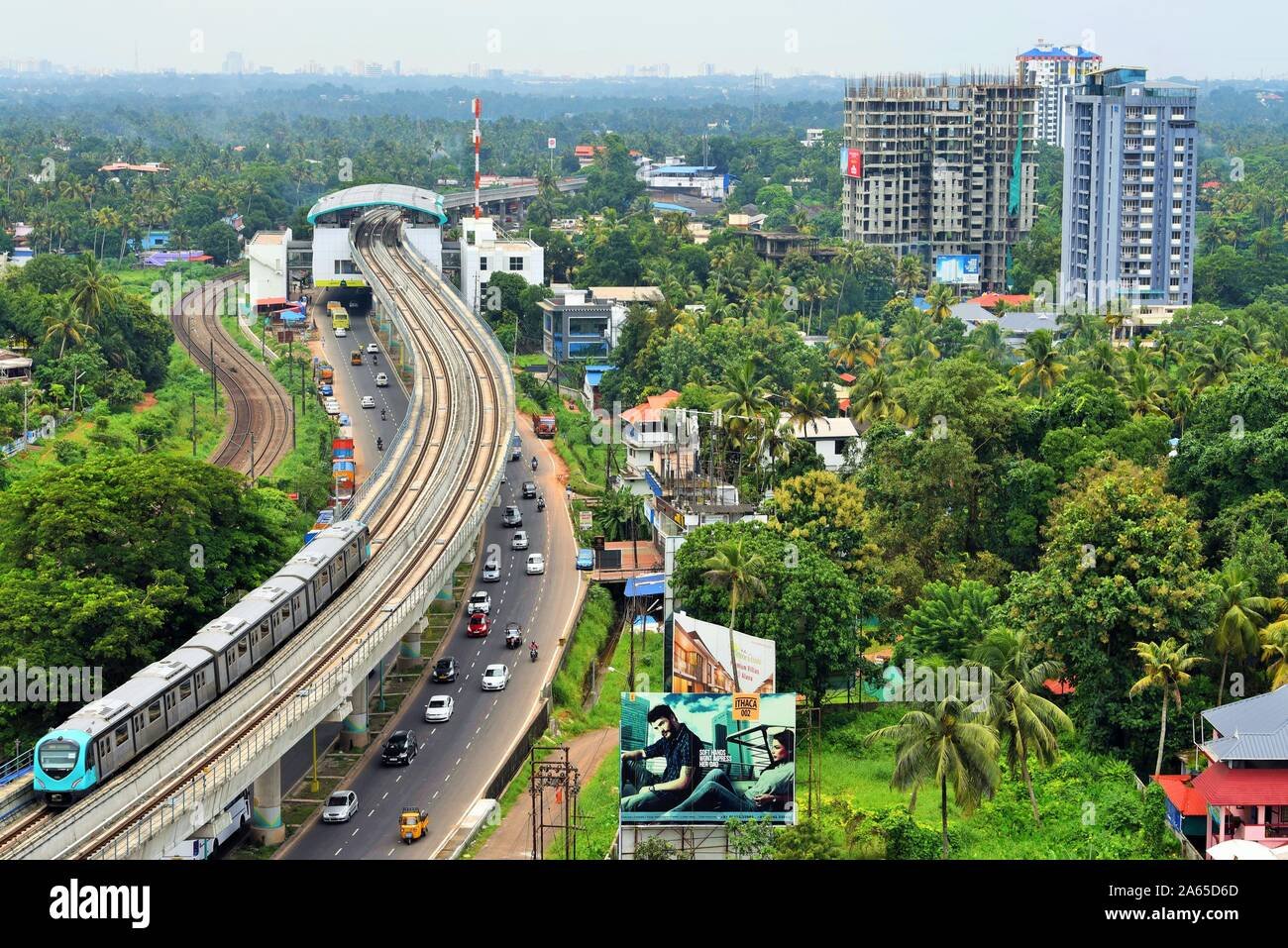

“The Indian office space is thriving today with the emergence of new commercial hotspots in each city. The creation of the emerging commercial districts has been facilitated by the development of infrastructure, new metro lines, and mass transit enablers such as the coastal road and Atal Setu in places like Mumbai,” said Rahul Arora, head of office leasing advisory and retail services, India, at JLL.

Mumbai, India’s financial capital, and its satellite city of Navi Mumbai are experiencing a significant transformation in the office real-estate landscape. While traditional business hubs like Nari- man Point and Bandra-Kurla Complex (BKC) maintain their ap- peal, new locations and complexes in Worli, Lower Parel, Goregaon, Powal and Navi Mumbai’s Airoli- Ghansoli are emerging as prominent destinations for companies to set up offices.

New commercial complexes such as Altimus in Worli, One International Center in Lower Parel, Maker Maxity in BKC, Minds- pace IT Park in Airoli and Aurum Q Park in Ghansoli are buzzing as vibrant business hubs. Renewed interest in the Lower Parel-Worli belt is driven by the benefit of the Colaba-SEEPZ metro line, coastal road and the newly opened AtalSe- tu. There is a preference for modern, sustainable and well-equip- ped offices managed by institutional landlords.

Lately, technology firms are preferring cost-effective locations of Thane and Navi Mumbai. Tata Consultancy Services has taken up 3 million sq ft in Thane, while Accenture has leased 2.1 million sq ft in Airoli and Capgemini has a 10-acre campus in Airoli.

In Gurugram, while office buildings on National Highway 8 have always been in demand, a supply shortage has pushed companies to other areas of the National Capital Region. About 12 million sq ft of space at Cyber City Gurgaon by DLF is completely occupied, while the recently completed buildings at Cyber Park and Downtown were already leased before their completion. New buildings that are coming up are also in huge demand and are lea- sed in the construction phase itself. Swedish telecom equipment maker Ericsson recently signed pacts to lease up to 525,000 sq ft from Skootr at the Vatika One-on-One building in Gurgram. Tata-owned Air India leased an over 620,000 sq ft built-to- suit office in Guru- gram’s Sector 75 for a training centre. Both complexes are close to NH8, suggesting that proximity to the main road is a key factor in finalizing office space.

In Bengaluru, the rise of IT companies spurred significant development in suburban markets like Electronic City and Whitefield by the early 2000s. Construction of the

outer ring road (ORR) in 2002 further transformed the Karnataka capital into India’s Silicon Valley, with the ORR emerging as the lar- gest office market in the country.

The ORR stretch, particularly ORR-South, remains a preferred destination for multinational companies, boasting over 67 mil- lion sq ft of Grade-A stock. Whitefield, with renewed interest driven by metro connectivity, al- so continues to attract occupiers with prevailing rents of ₹52-55 per sq ft.

“Infrastructure development is driving the office market along with the conventional factors such as cost efficiency, desire for a high-profile business address, and availability of talent,” said Arpit Mehrotra, managing director, office services, Colliers India.

In Chennai, OMR Zone 1, spanning from Madhya Kailash to Perungudi, has been a major driver of office space demand in recent years. In 2023, nearly 40% of the demand for office space originated from this micro market. Alongside tech giants like Amazon, financial services companies such as HSBC and Bank of Ameri- ca have established their offices along the stretch.

Recent key transactions in Chennai include Bank of America lea- sing 1.1 million sq ft at DLF Down- town in Taramani and LTI Mind- tree taking up 600,000 sq ft at L&T Innovation Campus in Manapakkam. Hyderabad, India’s emerging tech hub, continues its re- markable expansion westward, fuelled by robust infrastructure support from the Telangana government.

The city’s evolution from the old central business district areas of Jubilee Hills to the vibrant IT corridors of HITEC City and Gachibowli has been notable.