Cos, which have around 3m sq ft of retail space each in Mumbai, are on the lookout for more.

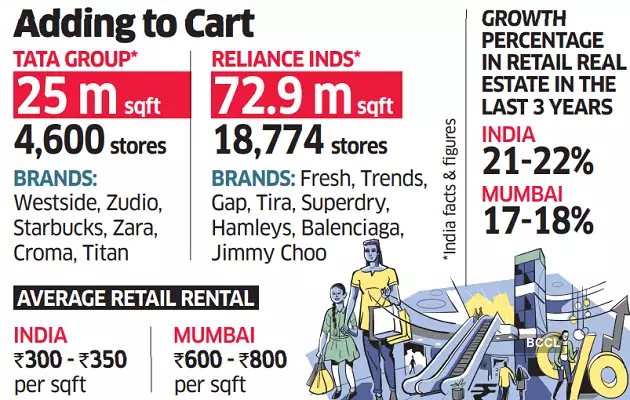

Mumbai: Tata Group and Reliance Industries, two of India’s largest conglomerates, are vying for premium real estate in Mum- bai as they extend their footprints. From Zara and Starbucks to West- side and Titan, the Tata Group occupies nearly 25 million of retail space in India. That is still no match for Reliance Industries that control three times more at 73 mil- lion sq ft of space for more than 100

local and global brands. But their dominance ends in Mumbai, where both Tata and Reliance have nearly 3 million sq ft of space each in the financial capital. That is a quarter of what is considered the most prime re- tail real estate in the country.

“In a modern retail environment, the most visible locations contain more successful or lar- ger brands. And it just so hap- pens that many of those brands are owned by either Reliance or the Tatas,” said Devangshu Dutta, founder of Third Eyesight, a strategy consulting firm. “Tatas have been in retail for longer but also slower to scale up compared to Reliance which had this stated ambition of being the most dominant and put the mo ney behind it.”

In India, Tata entered retail in the late 80s initially by opening Titan watch stores and a decade later by launching department store Westside. So far, it has about 4,600 stores including brands such as Tanishq, Starbucks, Westside, Zudio, Zara and Cro- ma. While Reliance Retail star ted in 2006, it overcompensated for its late entry by aggressively opening stores across formats.

And numbers bear witness. At present, Reliance has over 18,774 stores across supermarkets, electronics, jewellery, and apparel space. It has also either part- nered or acquired over 80 global brands from Gap and Superdry to Balenciaga and Jimmy Choo.

According to Knight Frank India, high streets occupy 15-16 mil lion sq ft of retail real estate while malls have 96-98 million sq ft retail real estate in the country In Mumbai, malls occupy 17-19 million sq sq ft ft and high streets at 3-4 million sq ft. There is a stark difference in rentals too with Mumbai’s average rent at ₹600 800 per sq ft. more than double compared to the national average at ₹300-350 per sq ft.

And this is where developers and landlords separate the wheat from the chaff. Ultimately success in Mumbai’s retail real estate scene hinges on a delicate equilibrium between accommodating industry leaders and fostering a vibrant, varied shopping environment, say experts.

“In the competitive landscape of retail real estate in Mumbai, commercial developers and mall owners often face the strategic challenge of accommodating prominent retail brands. These big brands, with a significant market share of 40-45% in the Indian retail sector, can easily be termed as industry giants and possess the potential to command 45-50% of space in any mall, Abhishek Sharma, di- rector retail, Knight Frank India.

LATE ARRIVAL

While Reliance Retail started in 2006, RILover- compensated for its late entry by opening stores across formats.

BIG FOOTPRINT

Tata Group has about 4,600 stores including brands such as Tanishq, Star- bucks, Westside, Zudio & Croma